If you want a quick summary how the American political and economic system is so skewed toward the wealthy, contrast these two reports.

If you want a quick summary how the American political and economic system is so skewed toward the wealthy, contrast these two reports.

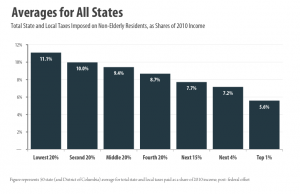

First, the Institute on Taxation and Economic Policy issued a report on the most regressive (Washington state!) and most progressive state tax systems, taking into account all state, local, excise, and property taxes (but not fees, licensing, etc).

Much is being made already out west about Oregon’s ranking as among the most progressive and Washington’s as most regressive, but the takeaway table for me is at the end.

In only two states, New York and California, do the total tax rate paid by the top 5% exceed 17%. In six states, the top 5% pay 15% or more of their income in taxes.

Contrast with the bottom 20% of the income distribution. In 27% states, they pay a state tax rate higher than 10% of their income, on average.

Now let’s see how much income these two segments of society receive. According to Federal income tax data from 2010, the top 10% control 33.1% of all income, while the lowest half of the income distribution receives only 11.7% of income.

The reason: a heavy reliance in many states on the sales tax, and a gradual shift away from progressive income taxes.

So much for an American tax system that unfairly targets high income earners.

It’s good to be rich and pay state taxes. And it sucks to be poor.

First, the Institute on Taxation and Economic Policy issued a report on the most regressive (Washington state!) and most progressive state tax systems, taking into account all state, local, excise, and property taxes (but not fees, licensing, etc).

Much is being made already out west about Oregon’s ranking as among the most progressive and Washington’s as most regressive, but the takeaway table for me is at the end.

In only two states, New York and California, do the total tax rate paid by the top 5% exceed 17%. In six states, the top 5% pay 15% or more of their income in taxes.

Contrast with the bottom 20% of the income distribution. In 27% states, they pay a state tax rate higher than 10% of their income, on average.

Now let’s see how much income these two segments of society receive. According to Federal income tax data from 2010, the top 10% control 33.1% of all income, while the lowest half of the income distribution receives only 11.7% of income.

The reason: a heavy reliance in many states on the sales tax, and a gradual shift away from progressive income taxes.

So much for an American tax system that unfairly targets high income earners.